SPAC? What is it?

We explain you what a SPAC is and how you can take profit with a SPAC.

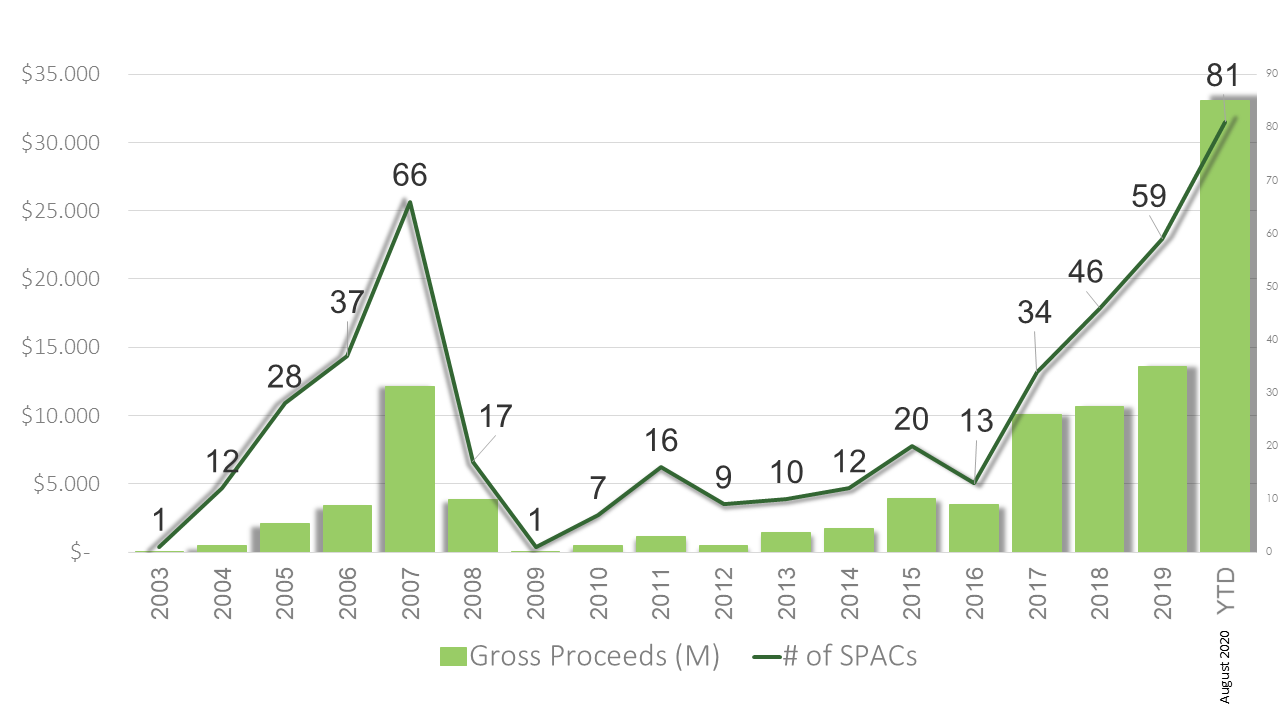

SPAC – An increasing success story

More than 40% of 2020’s IPOs by volume have been SPACs, raising $31.6 billion, more than double all of last year’s volume of $12.4 billion.

Evolution of Special-Purpose Acquisition Companies

First, the historically low interest rates. Since safe bonds pay less than 1% and stocks are traded at high valuations, more investors are willing to park their money at a SPAC because high returns are likely to be achieved when an acquisition is made. Second, the long-lasting boom in private equity and venture capital – investors who have put money into buying companies over the last years want to liquify their investments.

We changed and tinkered with a lot of the features to improve in the program and eliminate some of the regulatory tension that the SEC didn’t like, and other features that business people thought were causing problems.

-

Better known participants: More well-reputed Sponsors and executives from blue-chip corporations

-

Bigger IPOs: The average size in 2015 was below $200 million and reached an average of over $400 million in 2020

-

Business combinations: A steady increase of successful closings (90%) in opposite to liquidations of former SPACs (20%)

Our knowledge serves as the foundation for your success

Celtic Asset & Equity Partners is in permanent exchange with the parties involved in the market in order to contribute their experiences and assessments to an optimization of a SPAC right from the beginning.

-

Law firms

-

Investment banks

-

Certified Public Accountants

-

Insurance companies specialized in SPAC

-

Investor Relations consultants

-

FINRA broker and

-

Executive consultants.

This constant two-way communication enables us to provide our clients with an indication of the current status of Special-Purpose Acquisition Companies and their perception in the markets.

Summarized Overview on SPAC

A Special Purpose Acquisition Company is a newly formed corporation formed by a prominent and qualified management team for the purpose of raising capital in an initial public offering in anticipation of identifying and completing a business combination.

The corporation is usually incorporated in Delaware, the Cayman Islands or the British Virgin Islands, but any jurisdiction is suitable.

A SPAC has no business activity until the first acquisition is completed. After the merger or acquisition of the target company (‚the Business Combination‘) the new corporation is now a regular public corporation, traded at a well-reputed stock exchange like Nasdaq or NYSE. While other stock exchanges like Euronext and SEHK are suitable as well, the New York exchanges are by far the leading stock exchanges by number and volume that are dealing with SPACs.

Celtic supports the managment team to identify suitable target companies for the Business Combination of the particular SPAC.

Summary what a Sponsor will receive / ROI

SPAC provide a potential permanent capital solution for sponsors through access to public markets, which allows for more open-ended private equity investments

To start a SPAC, the pre-IPO expenses have to be covered and are paid against a promissory note by the Sponsor. A at risk capital of approximately 5% is paid and used as working capital; in exchange, the Sponsors recive a unit of a founder share and a warrant plus a premium in equity that values up to three times of their investment.

Why Top Executices Devote to SPACs

For many recently retired Chief Executives, leading a SPAC offers the optimal combination of opportunity and activity. The large majority of former public company CEOs are not interested in jumping back into a similarly all-consuming leadership role.

They have been there, done that, and most have taken enough chips off the table to be choosy. But most CEOs want to stay active in business and are eager to pursue interesting opportunities.