Special-Purpose Acquisition Companies

A SPAC is a publicly traded corporation formed solely to raise capital to effect a business combination.

What is a SPAC?

A Special-Purpose Acquisition Company is a new company going public (IPO) to raise capital from institutional investors to fund an acquisition. The acquired company should have an enterprise value of 2 to 4 times of the SPACs capital after the IPO (leveraged buy-out).

The SPAC should acquire a significant majority of the company taken over. A complete transfer of shares by a merger is preferred although, other forms of a business combinations is possible, e.g. as holding company or a joint venture. The acquisition could be compensated in cash, debt or (issuing new) shares of the SPAC.

What are the Benefits of a SPAC?

Combining the management team with access to the capital needed to fund a merger, acquisition or asset sale, the SPAC offers the financial flexibility, capital structure and management to attract a broad variety of target transactions and investment opportunities for our clients.

We give you a comprehensive overview about the benefits for investors:

Why are (our) SPACs popular?

-

A Special-Purpose Acquisition Company is a unique financial tool for raising institutional capital for acquisitions based solely upon the expertise of an executive team.

-

A SPAC IPO raises capital relatively quickly, typically taking four months from start to finish.

-

A SPAC with cash has advantages in a global market characterized by debt.

-

SPACS offer private equity sponsors with liquidity and an exit strategy, and founders with substantial equity in the company in exchange for their talent and expertise.

-

Risk is minimized for a sponsor, with cash held in trust, and risk linked directly to the SPAC’s successful acquisition(s).

Our Approach

Celtic has an unique approach in consulting our clients during the process from start to a successful business combination:

-

We coordinate all of the involved parties and secure their communication.

-

We evaluate a proposed SPAC and its potential targets to optimize a timely acquisition.

-

We negotiate with the relevant parties to achieve the best outcome for the SPAC.

-

We provide experienced executives who have been recognized as professionals in the financial markets

We are not engaged by our clients, we partner with them. We are cofounders of each SPAC.

Our contributions of expertise, experience and effort are compensated in Founder Shares. In this way we are partners with our clients in the success of the SPAC.

Further Information about a SPAC Process

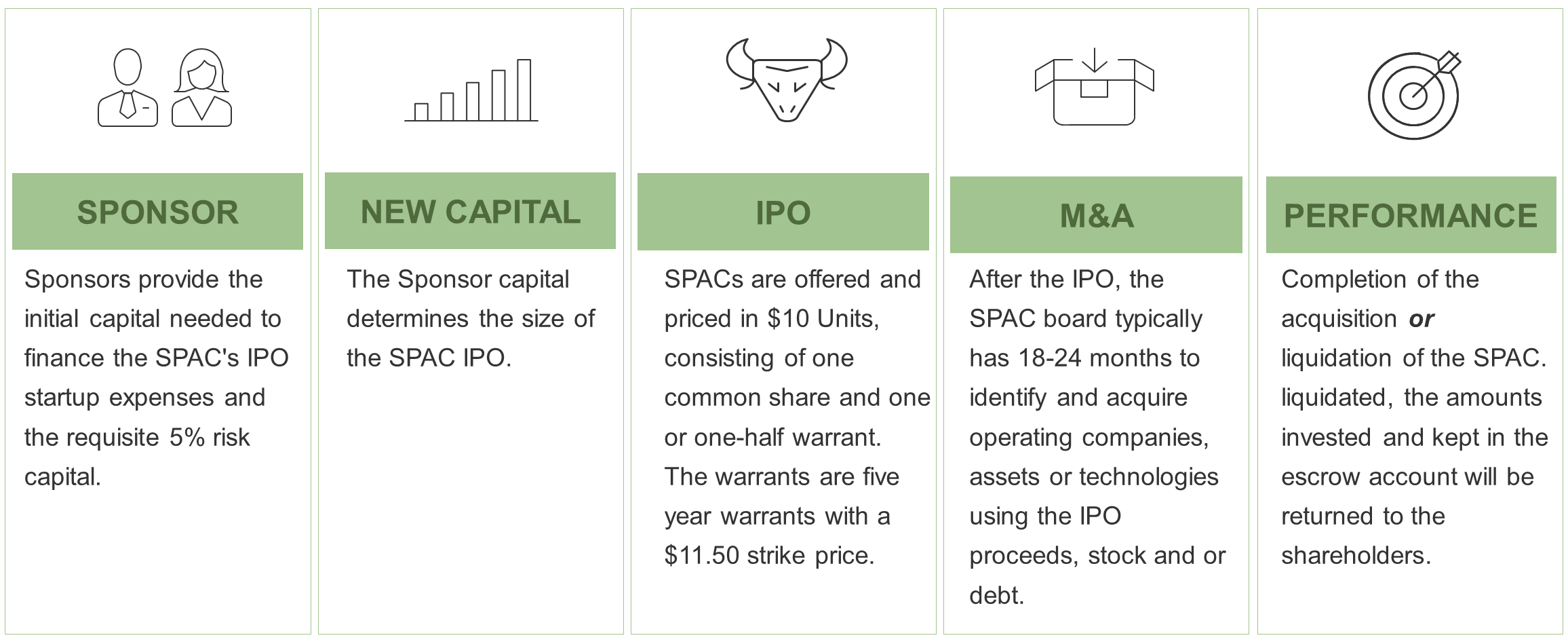

A SPAC from start to merger – we would like to give you a first overview about SPAC and the role of Celtic within:

SPAC provide benefits of an IPO with the flexibility of M&A

Related Insights

Benefits for Sponsors

SPAC have a number of benefits that have led private investors and PE-firms to use them to raise capital.

Our Services for you

We structure the SPAC-process from end-to-end and serve as your partner in this venture.

Upcoming SPAC Projects

We are proud to present you Celtic Asset & Equity Partners‘ involvement in forthcoming Special-Purpose Acquisition Companies.