PROSPECTUS

Filing the Registration Statement of a SPAC

In short

Preparing to go public

Most management teams have little or no experience with the details about going public with a company. We recommend leading advisors and servicing companies in the SPAC segment of an IPO as well as adding our experience. Further, we secure the communication between all involved parties.

Prospectus

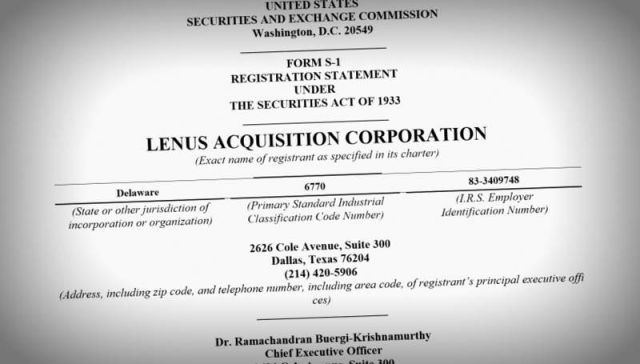

Form S-1 / Registration Statement

Optimize the Offer to Institutional Investors

A prospectus is a disclosure document that describes a financial security for potential buyers; it includes any material information about the company like information about business operations, capital use, financial situation, individual shareholder earnings, management, price per share and underwriters. The second part, which is not legally mandatory, includes information about the last sale of unregistered securities, financial statement schedules and relevant exhibits.

The most relevant mandatory sections of a Form S-1 are:

-

Summary Financial Data

-

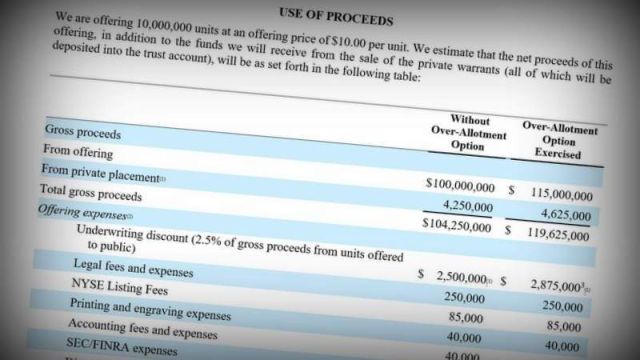

Use of Proceeds

-

Proposed Business

-

Managment Team

-

Principal Shareholders (Founder Shares)

The planned acquisition is described in the securities prospectus (Form S-1) only very general and generically:

Example of a Business Description in a Form S-1

PROPOSED BUSINESS

We are a Delaware blank check company incorporated on November 9, 2019 formed for the purpose of entering into a merger, share exchange, asset acquisition, stock purchase, recapitalization, reorganization or other similar business combination with one or more target businesses. Our efforts to identify a prospective target business will not be limited to a particular industry or geographic region although we currently intend to focus on target businesses that service the real estate industry. We do not have any specific business combination under consideration, and we have not (nor has anyone on our behalf), directly or indirectly, contacted any prospective target business or had any substantive discussions, formal or otherwise, with respect to such a transaction.

We will seek to acquire businesses that service the real estate industry. Our target companies will range from real estate service companies to PropTech companies. Real estate service companies include property management companies, real estate service providers, mortgage brokerage companies, real estate investments sales companies, title agencies and any other company that has its core business servicing the real estate industry. PropTech companies include companies that offer innovative software, hardware, products, operations or services that are technologically equipped to improve property ownership, financing, valuation, operations, management, leasing, property insurance, asset and investment management, design, construction and development.

We will seek to acquire established businesses of scale that we believe are poised for continued growth with capable management teams and proven unit economics, but potentially in need of financial, operational, strategic or managerial enhancement to maximize value.

Securities Counsel

Specialized law firm

Proven Legal Expertise

Securities Law is a spezialized and highly complex matter. Celtic Asset & Equity Partners works with the leading law firm in the SPAC industry. Advising more than 65 SPACs on issuer side and 35 SPACs on the underwriter side, the law firm participated in over 100 SPACs in the past five years; IPO proceeds exceeding $21.7 billion prove an outmost professional approach.

Starting the Filing Process

Proposed Business, Managment and Financials

While the Business Decription is very general, one should focus on the managment team – high qualified executives with a positive track-record and Wall Street experience will be appreciated by the markets; this expertise should be explained and proven in the prospectus. As the prospectus is a legally enforceable document and the issuer is responsible for any material misrepresentations or omissions,any claim in the prospectus has to be clear, true and must be verifiable.

An other major part are the financial tables and Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A). Celtic Asset & Equity Partners will prepare this for you as well and we will review this with the Auditors and Securities Counsels.